TOWARDS EQUITY: WEALTH IMPACTS FOR BLACK PROFESSIONALS IN CAREERS LAUNCHED BY INTERNSHIPS

Kelly D. Owens, PhD, INROADS, Inc.; Angela D. James, PhD, UCLA School of Education and Information Studies; and Adam Davids, Fulbright Scholar, Career Trackers

TABLE OF CONTENTS

Summary

This article expands upon the study of wealth impacts for students who matriculated through a career development program targeting African American, Hispanic, and Indigenous students. The study was conducted by Fulbright Scholar, Adam Davids, who was hosted by INROADS, a nonprofit organization focused on providing access and opportunities for career acceleration to students from backgrounds underrepresented in corporate leadership. Authors theorize that students who matriculate through the INROADS process can leverage training, professional experiences, and the support of peer connections to land in high-income careers and build wealth. An analysis of economic indicators shows considerable wealth enhancing outcomes, compared to college educated White peers, including heightened rates of homeownership, higher income, and comparable net worth.

Introduction

Eliminating racial and ethnic inequalities is a core concern in the United States. Since at least the time of the Civil Rights Movement, strategies for reducing racial inequalities have most often focused on programs to increase educational attainment among groups labeled as minorities. Education has been viewed as a critical component of the struggle towards social justice because the acquisition of literacy and numeracy are important to enhance human development broadly, and therefore has been viewed as an important tool for increasing the full and equitable participation of individuals in modern society. Alongside ideas about civic participation, the pragmatic reason that educational attainment has been given importance, is because of the link between acquisition of higher education with increased access to higher- income jobs (Oliver & Shapiro, 1994; Silvia, Evans, & Maume, 1996; Emmons & Ricketts, 2017). Simply put, most jobs with high wages come from jobs that require high levels of education. The assumption undergirding the focus on both educational attainment and its link with income is that income is critical to economic well-being. Racial disparities tied to economic status are believed to be consequences of systemic discrimination and policies of economic exclusion. Therefore, the drive to create a more just society and to reduce racial and ethnic inequality has very often been understood as the need to broaden access to education. By doing so, it is believed that economic rewards will be more equitably distributed.

The aftermath of the Civil Rights Movement has brought important changes in laws protecting against explicit discrimination which has resulted in declines in race and ethnic income gaps. However, in the last several decades, research has demonstrated that despite progress in reducing income inequality, race and ethnic gaps in wealth have not declined. Wealth, as an indicator of economic well-being, signifies a command over financial resources simply not captured by focusing on income alone. Because it is inclusive of income, savings, homeownership, and ownership of other assets (stocks, bonds, etc.), wealth gaps are a far better indicator of the magnitude of economic inequality (Blau & Graham, 1990; Emmons & Ricketts, 2017).

In this paper, we examine the wealth profiles of individuals who have completed the INROADS process. INROADS is a nonprofit organization focused on pathways to corporate leadership for underrepresented groups through career readiness programming. For this study, we utilize a novel strategy to discover and to comparatively examine the wealth profiles of INROADS participants. Comparing the wealth profiles of INROADS alumni to those of college- educated Whites, we find that INROADS participants are advantaged. In the next sections of this research brief we describe the INROADS program; our data and findings; and our understanding of how participation in INROADS garners success in reducing racial gaps in economic well- being.

WEALTH INEQUALITY AS AN ECONOMIC INDICATOR

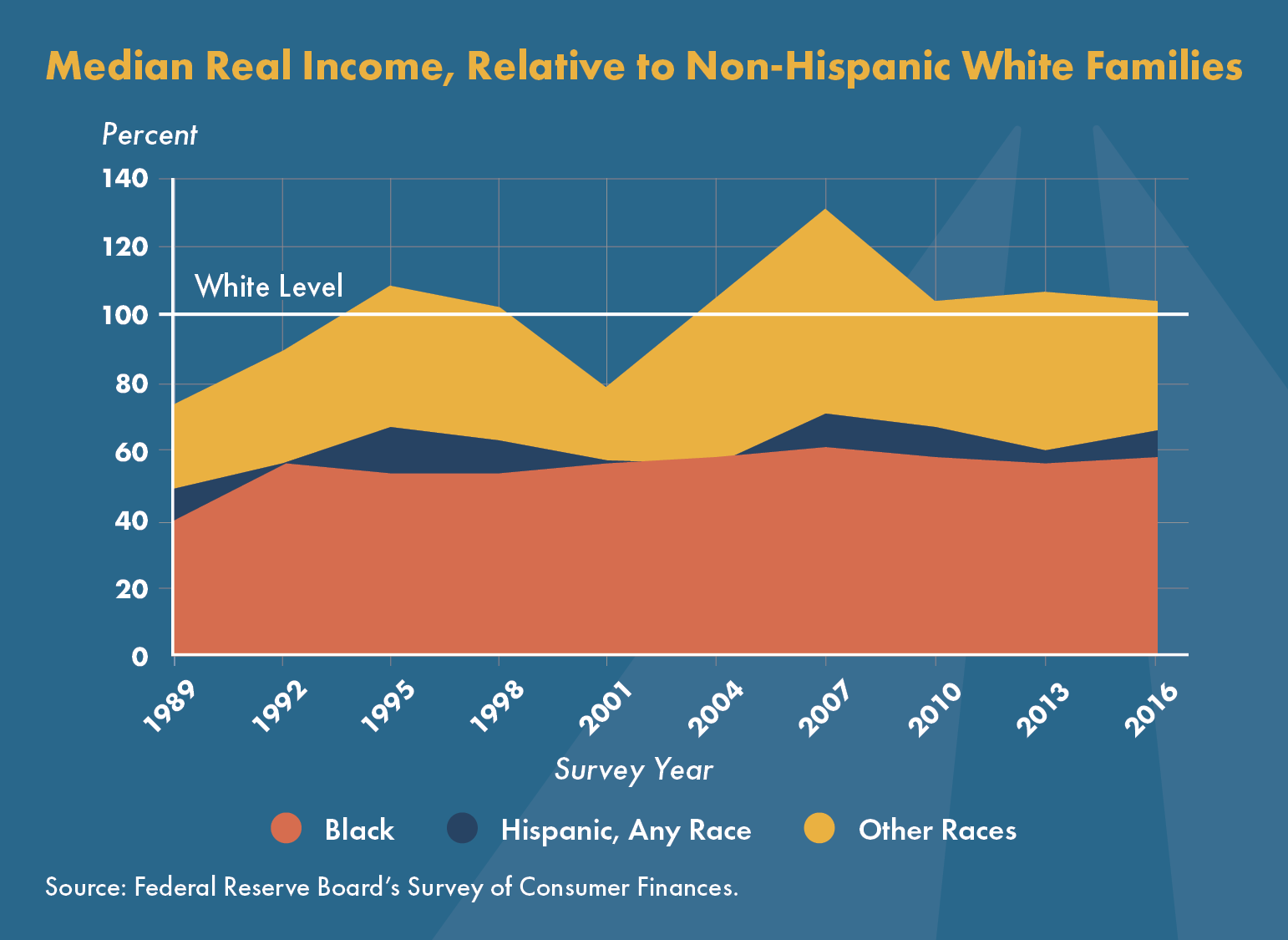

As mentioned in the introduction, education has been the predominant strategy used to address racial inequality - the struggle to improve access to education is an effort to improve access to higher paying jobs (Oliver & Shapiro, 1994; Emmons & Noeth, 2015). Parallel to educational attainment, racial income gaps have shown improvement in the decades since the civil rights movement. Between the 1960 and 1980’s, levels of college attainment rose significantly and a greater proportion of families of color were able to enter the middle class. Although families of color continue to have, on average, lower incomes than Whites, median income levels of Black and Hispanic Americans have grown considerably closer to that of Whites over time (Emmons & Noeth, 2015; Emmons & Ricketts, 2017). However, the gaps in wealth during this period have not improved nearly as much (Oliver & Shapiro, 1994). Studies have shown that Black and Latinx households have far less wealth as compared to their White peers (Blau & Graham, 1990; Oliver & Shapiro, 1994). While no one would argue that college attainment is unimportant, college attainment by itself is not enough to close the considerable racial and ethnic gaps in economic well-being that continue to disadvantage households of color.

Group differences in wealth have multiplicative and intergenerational impact. For example, if a family has more wealth to draw upon, they have a greater ability to finance their child’s education and help with the purchase of the child’s first home, both actions that can help establish a faster trajectory for young adults to begin building their wealth portfolios by virtue of having a college education which both increases access to higher paying jobs, leaving them with lower amounts of student loan and other debt (Oliver & Shapiro, 1994; Killewald & Bryan, 2018). The combined impact of higher incomes and lower debt profiles that young adults from wealthier families have generally helps them to become homeowners earlier in life and illustrates the numerous ways that wealth inequality may be multiplicative both intergenerationally, and over an individual’s life course (Oliver & Shapiro, 1994; Killewald, & Bryan, 2016).

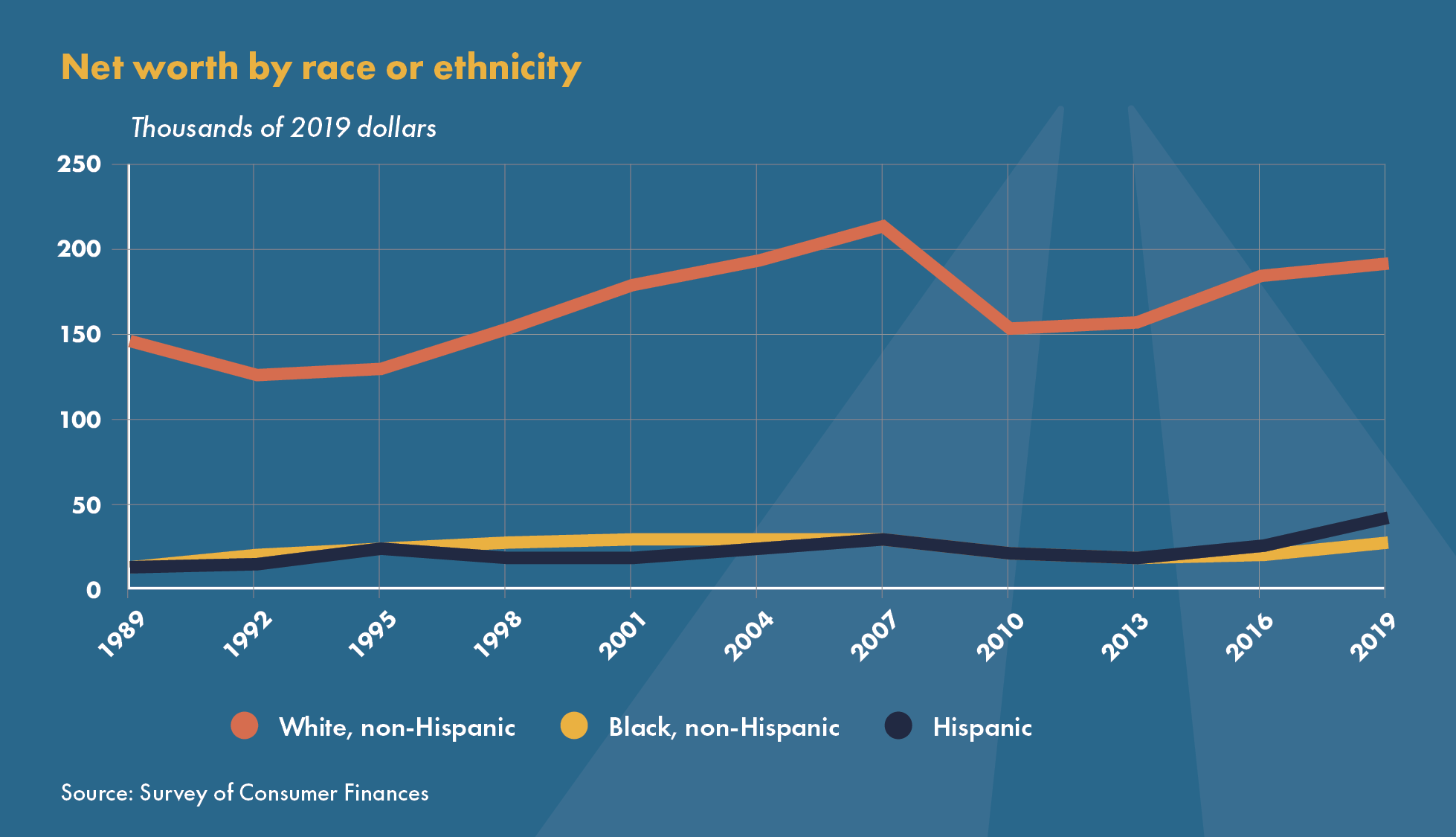

Evidence of the lack of progress in reducing the wealth gap is sobering. Despite civil rights legislation in the areas of employment and in housing discrimination, wealth gaps between blacks and whites are as substantial today as they were in 1968. Adjusting for inflation, while in 1968, a typical middle-class Black household had $6,674 in wealth compared with $70,786 for the typical middle-class white household (Peterson and Mann, 2020). Most current numbers show net worth at $24,100 for Blacks and $188,200 for Whites (Survey of Consumer Finances 2019). So, while the sheer amount of wealth has increased substantially among middle-class Black households, racial gaps in wealth profiles have more than doubled. The chart below shows that since 1989, White net worth has substantially outpaced the net worth of Black families. Wealth gaps can also be observed among households with similar income levels. For example, among those in the top 10 percentile, the median net worth for White families in this group is $1,789,300, compared to $343,160 for Black families (Emmons and Noeth, 2017).

Changes in educational acquisition have not proved effective in shrinking racial wealth gaps despite its salutary impact on income. Extending the earlier example clarifies why this is the case. An individual whose family lacks the capacity to finance their education would likely take out considerable loans to attain a college degree. So, even if the graduate in this example was able to acquire a similar income as a person from a wealthier family, they will begin their career with far more debt and therefore have considerably fewer resources available to invest in activities that could create more wealth, such as homeownership, business ownership, or investments in stocks, annuities and other revenue-generating opportunities.

BARRIERS TO REDUCING THE RACIAL WEALTH GAP

Barriers to reducing the wealth gap are those things that make it difficult for individuals to earn higher wages, buy a home, accumulate savings, or invest. Historic discrimination and ongoing economic exclusion of Blacks have been major contributors to the widening wealth gap. A direct example can be found in the policy and practice of redlining, that is, the practice of rejecting or restricting access to loans and financial services based on the neighborhood racial make-up of different communities. Redlining practices were both solidified into federal policy and used by private banks, and have had an enormous impact on residential segregation and on ongoing racial wealth disparities in modern communities (Conley, 2009; Peterson & Mann, 2020). The largest asset of most Americans is the equity they have in their homes. Consequently, the practice of redlining impacted both the ability of Black men and women to achieve homeownership, as well as the economic value of homeownership once attained. Whites currently have more equity in their homes 1) because they are able to purchase homes where values rise faster; and, 2) because they are able to purchase earlier in the life-course (Oliver & Shapiro, 1994; Conley, 2009). For similar reasons, White men and women have considerably higher rates of business ownership.

A more subtle example of the barriers to reducing the racial wealth gap is that contemporary Black people, whom have been able to access higher levels of education and income without the advantages of their family of origin’s wealth, are far more likely than their white peers to experience what is known as ‘network poverty’ (Oliver & Shapiro, 1994). By this, it is meant that they are much less likely to have people within their social networks who can provide them with recommendations or give them substantial economic advice or loans for education or business start-ups. Persons who are the first in their family to go to college or who are the first in their family to enter a particular field of employment often lack access to informal networks and training. By contrast, families whose members have college experience and access to networks of individuals in high-income industries can leverage these relationships to broker access to high level internships and job experiences. In summary, racial wealth gaps are the product of gaps in opportunity, income, job benefits, the ability to accumulate savings, the intergenerational transfer of wealth, as well as, advantages that accrue by virtue of social networks. In each of the areas mentioned, the circumstances of the past have resulted in continuing and even growing racial/ethnic wealth gaps (Peterson & Mann, 2020). Further, while the exclusion of individuals who lack such networks may not reflect intention to discriminate, the aggregate impact of this cycle of nepotism in access to information and opportunities results in disproportionately fewer high-income and wealth generating opportunities for similarly qualified non-Whites. (Oliver & Shapiro, 1994; Boen, Keister & Aaronson, 2020).

METHODS

Data for this study was obtained from a unique strategy whereby 2017 survey data of INROADS Alumni was combined with data obtained from the data science research tool, Wealth Engine. Wealth Engine draws on publicly available data points for 180 million US-based households and 250 million adults to generate wealth profiles of U.S. households. These wealth profiles were created for a random sample of 1,000 INROADS Alumni survey respondents, thereby creating a dataset with an in-depth assessment of homeownership and household wealth. A validation process to corroborate the linkage of names and current addresses for alumni confirmed accurate homeownership, wealth, and income data for 70% of individuals in the sample. Data for the comparative net worth of the general population of Black and White college-educated households were obtained using the 2017 Survey of Consumer Finance conducted by the Federal Reserve.

KEY FINDINGS

There are substantial racial gaps in real income. Black families and Hispanic families earn substantially lower incomes compared to non-Hispanic white families. These lower income levels make it very difficult to reduce racial gaps in wealth.

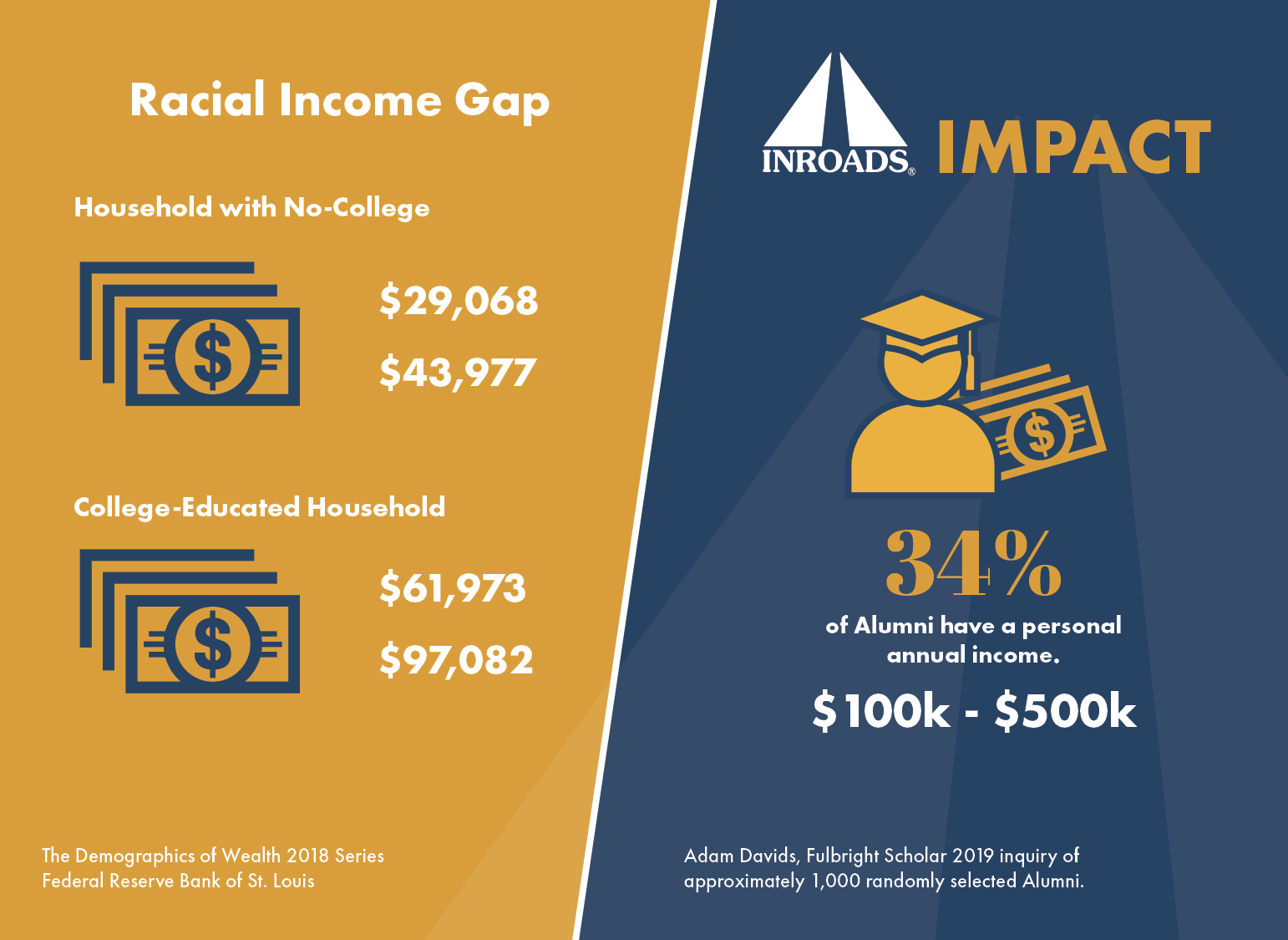

Illustrating the limitation of strategies for reducing the racial wealth gap that focus solely on educational access, Figure 3 shows substantial racial gaps in median income among householders with and without college degrees. Among those without a college degree, whites earn almost 41% more, while among those with a college degree, white households earn income that is 44% higher than Black families. However, for 34% of individuals who completed the INROADS process, incomes exceed median income for college-educated White households.

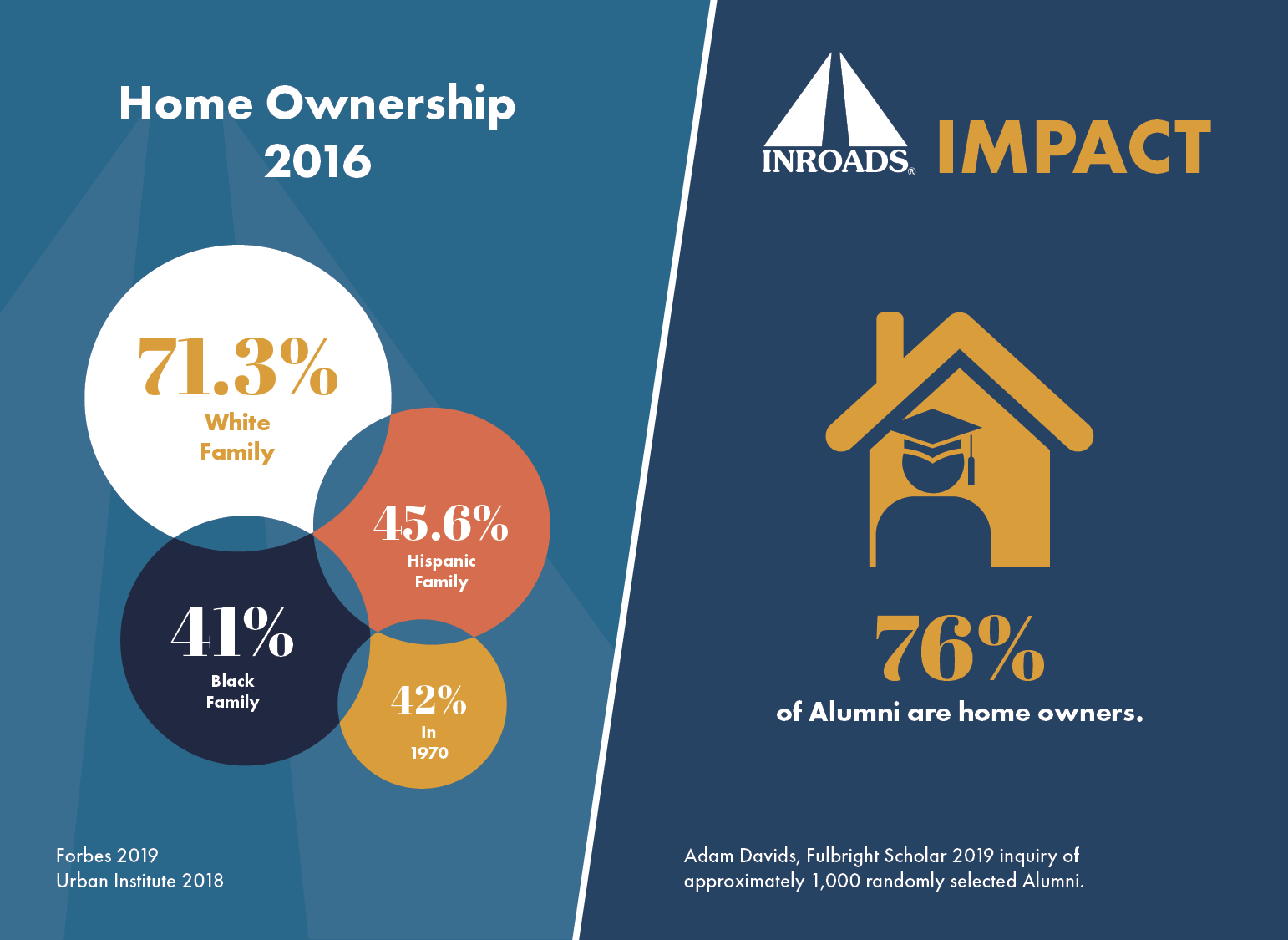

Among the most critical components of wealth accumulation is homeownership. Racial gaps in homeownership are illustrated in Figure 4. While over 71% of white families own homes, only 41% of Black families and 46% of Hispanic families do so. For INROADS alumni, homeownership rates are at 76%.

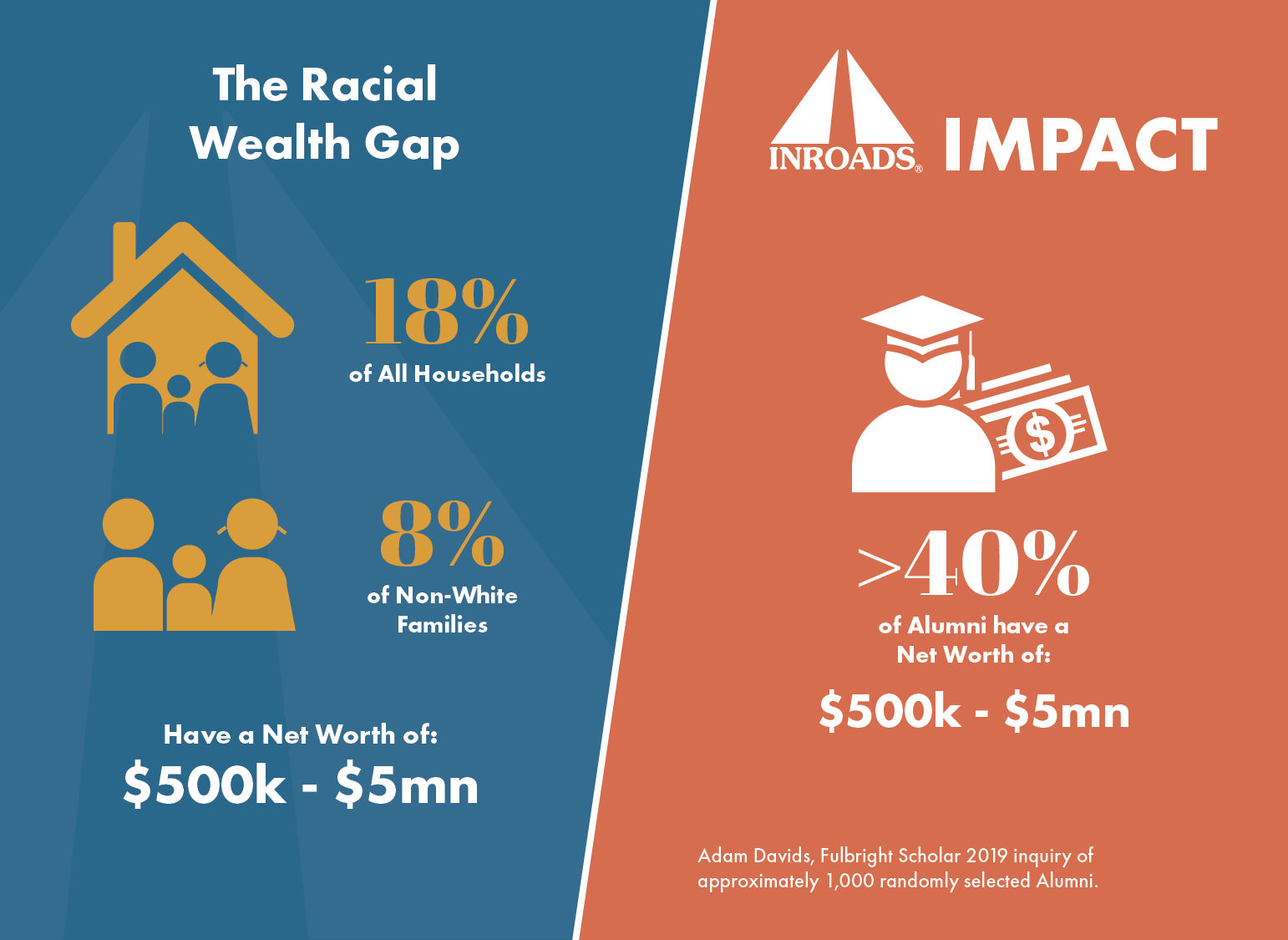

INROADS Alumni are also advantaged when looking at wealth more broadly. While only 18% of all households and 8% of non-white families have a net worth that exceeds $500,000, more than 40% of INROADS Alumni from our sample group have attained this level of financial security.

DISCUSSION

The findings suggest that programs, like the ones offered by INROADS, which focus on key levers of economic mobility, may play a critical role in reducing or even eliminating racial wealth gaps for its participants. As discussed, while education can certainly facilitate entry into high income careers, educational attainment alone does not eliminate racial gaps in income, or in wealth attainment. Our review of the literature suggests the importance of facilitating the following activities in reducing racial gaps in wealth:

-

entry into high-income generating fields

-

early career placement

-

establishing and leveraging career networks

-

early homeownership

INROADS started in 1970 to prepare and provide greater access to ethnic minorities to careers in business and industry. The founding mission of INROADS was to create leadership development and internship programs that would eliminate access and network barriers often experienced by job seekers from underrepresented groups. Key components of the organization’s approach have been to provide students with leadership development and training, along with forming partnerships to facilitate internship placements. INROADS currently includes a range of programs that operate across various employment sectors, including STEM and business. The programs mounted each year are high-touch and extend from pre-career education for high school and college students, internships and early career leadership development and mid-career peer networking. By creating and facilitating continual access to influential professional and peer networks for its participants, INROADS is able to interrupt the cycle of network exclusion for first-generation and underrepresented program participants.

Dedicated teams of staff, many of whom have been with the organization for more than 15 years, specialize in student development, career coaching, and cultivating corporate partnerships. Professional staff foster program fidelity by ensuring all students receive top-notch training and high-touch support that permeates all program areas. Additionally, INROADS’ long-standing partnerships with corporations and continued development of partnerships in emerging industries, play a key role in program success. Companies place INROADS interns in entry- level positions allowing them to gain hands-on experience that subsequently provides a competitive edge for students as they enter the workforce with a prerequisite understanding of how to navigate the corporate environment. The relationships developed over the years have created mutually beneficial partnerships whereas companies enrich the INROADS learning process by creating learning labs where students feel welcome yet are challenged by being assigned substantive projects while being nurtured by experienced intern supervisors. Companies benefit by gaining early access to highly capable, diverse talent.

In this manner, INROADS’ organizational design reflects the understanding that real impact requires more than a simple singular focus on education, training, or on mentorship and internships. In fact, INROADS Alumni report the comprehensiveness of the INROADS process as the foundation for their career success. Components of the INROADS process which are associated with the favorable wealth outcomes of its program participants include:

-

Cultivating pipelines of high potential students beginning with high schoolers and developing programs to improve college completion rates.

-

Ensuring that program participants acquire skills identified by employers as key competencies for career advancement.

-

Customizing training programs and partnerships focused on entry into high-income careers (e.g., finance, healthcare).

-

Supporting and training students interested in becoming entrepreneurs.

-

Educating students on how to accumulate wealth through financial literacy courses.

-

Facilitating the development of peer networks and the sustaining of those networks

through alumni programs.

-

Matching students to mentors, including corporate executives, that can both help them navigate

the workplace, but also serve to expand their professional networks.

-

Matching students to potential employers that provide paid internships which helps

students minimize educational debt and facilitate entry into high earning careers.

CONCLUSION

The wealth profiles of INROADS alumni as compared to their peers suggest the important role that such programs can play in augmenting formal education, and thereby make real impact on income potential, wealth accumulation, and economic well-being for groups that have previously been excluded from such opportunities. The longevity of INROADS, along with its ongoing engagement with program alumni, help to ensure continuing expansion of corporate partnerships and social networks available to new program participants. In this manner, there is likely an intergenerational aspect to the INROADS process, much like wealth itself operates. While INROADS, as a single entity may not be enough to close the nation’s racial wealth gap entirely, scaling the efforts of INROADS to exponentially serve more students from underrepresented groups may have a considerable impact on eliminating key barriers to wealth accumulation for underrepresented groups.

About the Authors

Adam Davids is a Non-Executive Director at Social Ventures Australia and a Fulbright Scholar focused on establishing a robust framework of workplace equity standards for Indigenous Australians.

Adam Davids is a Non-Executive Director at Social Ventures Australia and a Fulbright Scholar focused on establishing a robust framework of workplace equity standards for Indigenous Australians. Dr. Angela James is currently Research Director at the Center for Transformation of Schools at UCLA. A seasoned scholar, sociologist, consultant, and ardent community organizer/activist, Dr. James has devoted her professional life studying poverty and inequality and her personal life working to eradicate it.

Dr. Angela James is currently Research Director at the Center for Transformation of Schools at UCLA. A seasoned scholar, sociologist, consultant, and ardent community organizer/activist, Dr. James has devoted her professional life studying poverty and inequality and her personal life working to eradicate it. Dr. Kelly D. Owens serves as the Chief Impact & Strategy Officer at INROADS, where she oversees evaluation, training, and research activities for the organization.

Dr. Kelly D. Owens serves as the Chief Impact & Strategy Officer at INROADS, where she oversees evaluation, training, and research activities for the organization.REFERENCES

Blau, Francine D., & Graham, John W. Black-White Differences in Wealth and Asset Composition. 1990. The Quarterly Journal of Economics.

Boen, Courtney; Keister, Lisa & Aronson, Brian. 2020. “Beyond Net Worth: Racial Differences in Wealth Portfolios and Black-White Health Inequality Across the Life Course. Journal of Health and Social Behavior, Vol 61(2)153-169.

Conley, Dalton. 2009. Being Black Living in the Red

da Costa, P. 2019. “Housing Discrimination Underpins the Staggering Wealth Gap Between whites and Blacks” Economic Policy Institute. April 8, 2019

Dettling, Lisa J., Joanne W. Hsu, Lindsay Jacobs, Kevin B. Moore, and Jeffrey P. Thompson (2017). "Recent Trends in Wealth-Holding by Race and Ethnicity: Evidence from the Survey of Consumer Finances," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, September 27, 2017, https://doi.org/10.17016/2380-7172.2083.

Emmons, William R.; and Noeth, Bryan J. “Race, Ethnicity and Wealth.” The Demographics of Wealth, February 2015, Essay 1, https://www.stlouisfed.org/~/media/files/pdfs/hfs/essays/hfs-essay-1-2015-race-ethnicity-and-wealth.pdf.

Emmons, William R.; and Ricketts, Lowell R. “College Is Not Enough: Higher Education Does Not Eliminate Racial and Ethnic Wealth Gaps.” Federal Reserve Bank of St. Louis Review, First Quarter 2017, Vol. 99, No. 1, pp. 7-39. https://research.stlouisfed.org/publications/review/2017/02/15/college-is-not-enough-higher-education-does-not-eliminate-racial-and-ethnic-wealth-gaps/.

Glaude, Eddie S. Jr. 2017. Democracy in Black: How Race Still Enslaves the American Soul. Broadway Books.

Oliver, Melvin L., & Shapiro, Thomas. M. 1995. Black wealth/white wealth: A new perspective on racial inequality. New York: Routledge.

Silvia Cancio, A; Evans, David T; Maume, David J. “Reconsidering the Declining Significance of Race: Racial Differences in Early Career Wages”. American Sociological Review, Vol 61. No 4. Pp 541-556. 1996.

Sullivan, Laura, & Meschede. 2018. How Measurement of Inequalities in Wealth by Race/Ethnicity Impacts Narrative and Policy: Investigating the Full Distribution. Race and Social Problems. 10:19-29